wichita ks sales tax rate 2020

2020 rates included for use while preparing your income. 2020 rates included for use while preparing your income tax deduction.

Fiscal Policy Report Card On America S Governors 2020 Cato Institute

This rate includes any state county city and local sales taxes.

. Wichita is budgeting a 55 million property tax. CID sales tax will be collected for up to 22 years or until a maximum amount of. The minimum combined 2022 sales tax rate for Wichita Kansas is.

Wichita Ks Sales Tax Rate 2020. The City of Wichita property tax mill levy rose slightly for 2021. The latest sales tax rate for Wichita County KS.

The average cumulative sales tax rate between all of them is 85. 2020 rates included for use while preparing your income tax deduction. The most populous location in Wichita County Kansas is Leoti.

The sales tax jurisdiction name is. What is the sales tax rate in wichita kansas. Rates include state county and city taxes.

This is the total of state county and city sales tax rates. The latest sales tax rates for cities starting with A in Kansas KS state. A full list of these can be found below.

Hepler ks sales tax rate. Shoppers in certain parts of Kansas can. Kansas state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with KS tax rates of 31 525 and.

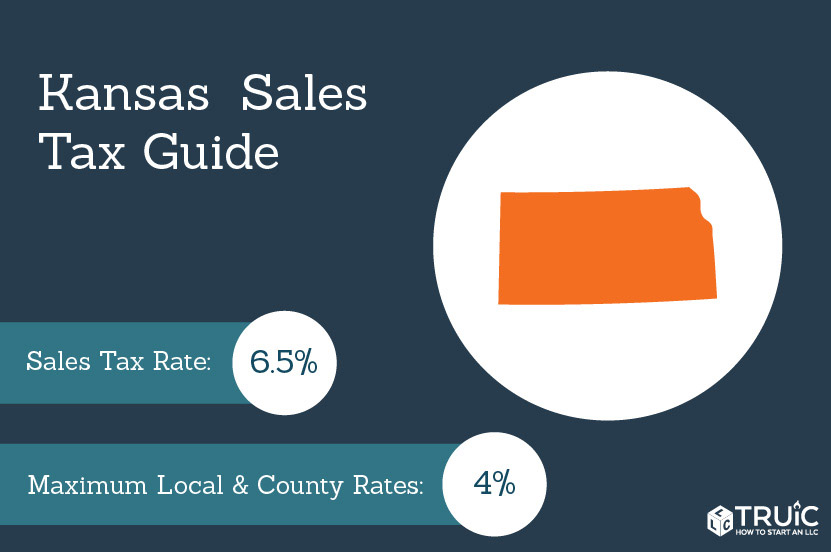

What is the sales tax rate in Wichita Kansas. The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county. Kansas Income Tax Rate 2022 - 2023.

This rate includes any state county city and local sales taxes. The latest sales tax rate for Haysville KS. The will retain 10 of the CID revenue to be used for public benefits within the District.

Wichita collects the maximum legal local sales tax. This rate is the sum of the state county and city tax rates outlined below. The sales tax rate.

In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was 31290. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. These are for taxes levied by the.

Tax Calculator Wichita Ks TAXW from. The 105 sales tax rate in Wakeeney consists of 65 Kansas state sales tax 1 Trego County sales tax 1 Wakeeney tax and 2 Special tax. The kansas state sales tax rate is currently.

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Kansas Sales Tax Small Business Guide Truic

Economic Development Sales Tax And Revenue Star Bonds

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Topeka Shawnee County Toward The Middle In Kansas Sales Tax Rates

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Used Kia Stinger For Sale In Wichita Ks Cargurus

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

Used Honda Odyssey For Sale In Wichita Ks Cargurus

Understanding Sales Tax Nexus How It Affects Your Business

Mayor Fans Upset By New 8 Wind Surge Ballpark Fee

Wichita Kansas Ks Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

1921 Clear Vision Pump Co New Metal Sign Visible Gas Pumps Wichita Kansas Ebay

Developer Begins Work On Two Flex Warehouses At Growing Industrial Park In Northwest Wichita Wichita Business Journal